How to Finance Your Tiny Pine Cabin in the US

Owning a cozy pine cabin offers a unique sense of freedom and a connection to nature. Many people dream of this lifestyle but hit a roadblock when it comes to funding. The path to securing money can seem complicated and different from traditional home buying. Understanding the specifics of tiny pine cabin financing is the first step toward making that dream a reality. This process involves exploring various loan types, understanding credit requirements, and finding the right lender for your unique situation. This guide breaks down everything you need to know about making your cabin ownership dreams come to life. To help you stay organized, we’ve also created a complete financial checklist, available for download at the end of this article.

Financing Options for Tiny Homes

Securing money for a small wooden house presents unique challenges. Traditional mortgages often do not apply because these homes can be mobile or lack a permanent foundation. Lenders see them as a higher risk compared to standard houses. However, a growing market means more specialized financial products are becoming available. Aspiring owners have several avenues to explore for their tiny pine cabin financing.

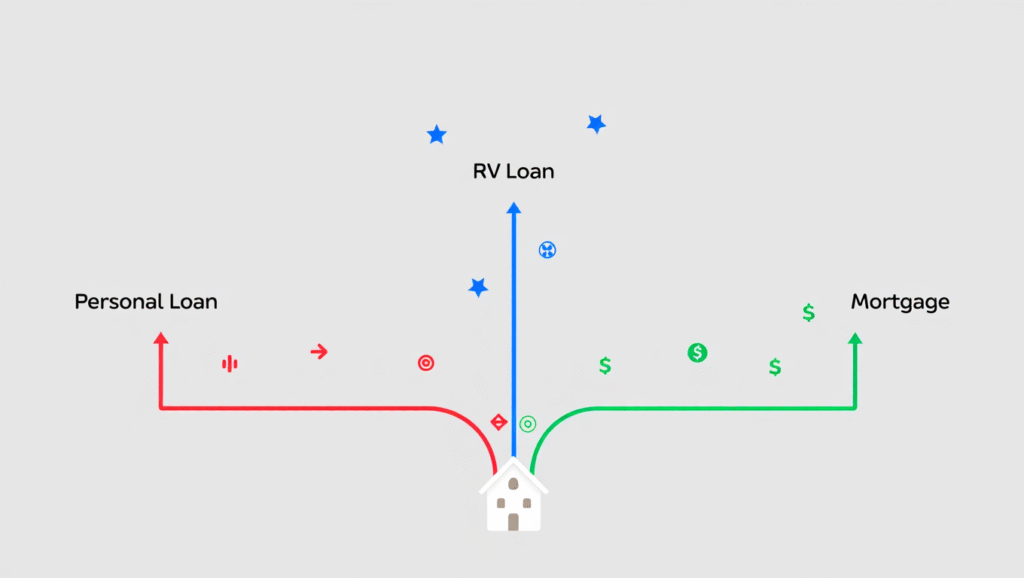

Exploring Loan Varieties

A variety of loan types can help you purchase your cabin. Each one comes with its own set of rules and benefits. Finding the right fit depends on your financial picture and the type of cabin you intend to buy. It is smart to look into all possibilities before making a commitment.

Here are some common financing routes:

- Personal Loans: These are often unsecured, meaning you don’t need collateral. Lenders approve them based on your credit score and income. Interest rates can be higher than secured loans, but the application process is usually faster and simpler. They offer flexibility for purchasing both the structure and the land.

- RV Loans: If your small pine dwelling is certified as a recreational vehicle (RV), you might qualify for an RV loan. These are specific loans for movable residences. Lenders who specialize in RVs understand the unique nature of these assets. This can be a great option for tiny home loans.

- Builder Financing: Some companies that construct these homes, such as those specializing in prefabricated cabins for off-grid living, offer their own financing plans. This can streamline the buying process significantly.You work directly with the builder to secure funding. They often have established relationships with lenders familiar with their products, making approval for affordable pine homes finance more likely.

Choosing the best option requires careful consideration of interest rates, loan terms, and your personal financial situation. Each path has its own advantages for securing your dream cabin.

Mortgage vs Personal Loan

When considering how to fund your cabin, a major decision is choosing between a mortgage and a personal loan. A traditional mortgage is a loan used to buy real estate, with the property itself serving as collateral. A personal loan can be used for almost any purpose and is often unsecured. Understanding the fundamental differences is crucial for your tiny pine cabin financing journey.

Weighing the Pros and Cons

The best choice depends heavily on the cabin’s classification. If the structure is on a permanent foundation and meets local building codes, it might qualify for a mortgage. This typically means lower interest rates and longer repayment terms. Personal loans offer more flexibility but often come with higher interest rates and shorter terms. A study on alternative housing finance (University of California, Berkeley, 2023) found that over 60% of tiny home owners initially sought traditional mortgages but ultimately used personal loans or cash due to classification issues. This highlights a common hurdle in the process.

For those seeking cabin financing US, a personal loan might be the more accessible route. The application is generally quicker, with funds becoming available in a matter of days. Mortgages, on the other hand, involve a lengthy underwriting process, appraisals, and more paperwork. This can postpone your purchase. The simplicity of a personal loan is a significant draw for many buyers.

A key principle for borrowers to remember is that the structure of the loan should match the nature of the asset.

This means a movable cabin fits better with a flexible personal or RV loan, while a fixed structure might benefit from a mortgage. Carefully evaluate how your cabin will be built and situated before choosing your financing path.

Government Programs and Grants

Government assistance can be a valuable resource for prospective cabin owners. While there are no federal programs specifically for tiny homes, some existing programs can be adapted. These options can make ownership more accessible, especially for first-time buyers or those with lower incomes. Investigating these avenues is a smart step in your tiny pine cabin financing plan.

Tapping into Federal and State Aid

Several government-backed loan programs can potentially be used. The Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) offer loans with favorable terms. These are not direct loans from the government but are insured by them, making lenders more willing to approve them. Finding a lender experienced in applying these programs to non-traditional housing is key.

Here is a comparison of potential government-backed options:

| Loan Program | Key Feature | Best For | Potential for Tiny Cabins |

| FHA Loans | Low down payment (as low as 3.5%) | First-time homebuyers, buyers with lower credit scores. | Possible if the cabin is on a permanent foundation and meets HUD standards. |

| VA Loans | No down payment required for eligible veterans. | Active-duty military, veterans, and eligible spouses. | Similar to FHA; requires a permanent foundation and appraisal. |

| USDA Loans | No down payment for homes in eligible rural areas. | Low-to-moderate income buyers in rural locations. | Excellent option if the cabin is in a designated rural area and meets program criteria. |

These programs offer a path to affordable pine homes finance. Financial advisor Dave Ramsey famously states: “Your biggest wealth-building tool is your income. Don’t tie it all up in payments.“

This advice is especially relevant when using government programs, which can offer lower monthly payments, freeing up your cash for other investments. Exploring these government-backed options could provide the support you need.

Credit Requirements

Your credit score is a major factor in securing any type of loan. For tiny pine cabin financing, a strong credit history is essential. Lenders use this three-digit number to gauge your reliability as a borrower. A higher score tells them you are less of a risk, which often translates to better loan terms and lower interest rates.

Building a Strong Credit Profile

Lenders look for a consistent history of on-time payments and responsible credit management. Before you apply for tiny home loans, it is wise to check your credit report for any errors. Dispute any inaccuracies you find, as this can improve your score quickly. Aiming for a score above 680 will open up more financing opportunities.

Here are essential areas lenders will scrutinize:

- Credit Score: Most lenders prefer a score of 700 or higher for the best rates. Scores in the mid-600s might still qualify but likely with higher interest.

- Payment History: A clean record with no late payments for at least two years is crucial. This shows you are a dependable borrower.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. Lenders typically want to see a DTI below 43%. A lower ratio indicates you have enough income to handle new loan payments.

- Credit Utilization: This refers to how much of your available credit you are using. Keeping this below 30% on all credit cards and lines of credit can positively impact your score.

Focusing on these areas will make you a more attractive applicant for cabin financing US. A solid credit foundation is the first step toward approval.

Down Payment Expectations

A down payment is the portion of the purchase price you pay upfront. For tiny pine cabin financing, the required down payment can vary significantly. Unlike traditional homes where 20% is standard, the amount for a cabin depends on the loan type and the lender. Planning for this expense is a critical part of the financial preparation process.

Saving for Your Initial Investment

Lenders often require a larger down payment for non-traditional homes to offset their perceived risk. For personal loans, a down payment might not be explicitly required, but having cash on hand for the purchase is always a good idea. For RV loans or specialized tiny home mortgages, expect to put down between 10% and 25%. A larger down payment can lead to a smaller loan amount and lower monthly payments.

The smartest financial move is to save more than you think you will need for a down payment.

Unexpected costs always arise during a home purchase. Having an extra cushion will reduce stress and prevent financial strain. Saving diligently before you start shopping for lenders shows financial discipline. This makes you a more appealing borrower and sets you up for success. This preparation is a vital part of planning for affordable pine homes finance.

Best Banks for Tiny Home Loans

Finding the right lender is just as important as finding the right cabin. Not all banks and credit unions are familiar with the tiny home market. It is best to seek out financial institutions that have experience with this unique type of housing. Working with a knowledgeable lender can make the entire tiny pine cabin financing process smoother and more successful.

Identifying a Knowledgeable Lender

Start your search with local credit unions. They are often more flexible and community-focused than large national banks. Some online lenders also specialize in tiny home loans. These fintech companies have built their business models around alternative financing. They understand the nuances of appraising and funding small, sometimes mobile, dwellings.

A key step is to get pre-approved from multiple lenders. This allows you to compare interest rates and loan terms without impacting your credit score, as long as you do it within a short time frame.

Suze Orman, a renowned financial expert, advises: “You need to be an active participant in your own rescue.”

This means taking charge of your lender search, asking tough questions, and advocating for the best possible terms for your cabin financing US. Do not be afraid to negotiate with potential lenders.

Private Financing Alternatives

Sometimes, traditional banking routes are not the right fit. Private financing offers another set of options for securing your cabin. This can include loans from individuals, partnerships, or specialized private lending companies. These alternatives can provide more flexibility, especially if your credit history is not perfect or if the cabin itself is highly unconventional. This can be a viable path for your tiny pine cabin financing.

Steps to Secure a Private Loan

Securing a loan from a private source requires a different approach than dealing with a bank. It is all about building trust and presenting a solid plan.

Here’s a step-by-step guide:

- Prepare a Detailed Proposal: Your first step is to create a comprehensive business plan for your cabin. This should include the total cost, your budget, how you will use the funds, and a clear repayment schedule. Treat it as if you were pitching to a professional investor.

- Identify Potential Lenders: Think about people in your network who might be interested in this type of investment. This could be family, friends, or local investors. There are also online platforms that connect borrowers with private lenders for real estate projects.

- Present Your Case Professionally: Schedule a formal meeting to present your proposal. Be prepared to answer questions about the risks and potential returns. Highlight your personal commitment and any collateral you can offer to secure the loan.

- Formalize the Agreement: Never rely on a verbal agreement. Work with a lawyer to draft a formal loan agreement or promissory note. This document should detail the loan amount, interest rate, repayment schedule, and what happens in case of default. This protects both you and the lender.

This approach ensures clarity and professionalism. It turns a personal request into a structured financial arrangement, increasing your chances of success.

Renting vs Owning Tiny Cabins

The classic rent-versus-buy debate applies to tiny cabins too. Owning a cabin means building equity and having a permanent retreat. Renting offers flexibility and fewer responsibilities. Both options have financial and lifestyle implications that are worth considering carefully before you dive into the world of tiny pine cabin financing.

Analyzing the Financial Trade-offs

Owning involves upfront costs like a down payment and closing costs, plus ongoing expenses like property taxes, insurance, and maintenance. However, every payment builds your equity. A 2024 study by the National Association of Realtors on vacation home trends indicated that owners of small cabins saw an average property value increase of 8% per year over the last five years. This demonstrates the strong potential for appreciation. Renting has a lower barrier to entry with just a security deposit and first month’s rent. Yet, you are not building any long-term wealth.

Deciding what’s right for you involves looking at your long-term goals. If you plan to stay in one area and want a tangible asset, pursuing affordable pine homes finance is a logical step. If you value mobility and want to test out the lifestyle without a major commitment, renting is a smarter choice. The decision ultimately rests on your personal financial situation and life plans.

Investment Potential

A tiny pine cabin can be more than just a personal getaway; it can be a savvy financial investment. The growing popularity of minimalist living and experiential travel has created a strong market for cabin rentals. This can provide a steady stream of income that helps offset your ownership costs. Recognizing this potential is an important aspect of your tiny pine cabin financing strategy.

Maximizing Your Return on Investment

To turn your cabin into a successful rental, location is paramount. Properties near national parks, lakes, or popular tourist destinations tend to have the highest occupancy rates. Marketing your cabin effectively on platforms like Airbnb and VRBO is also crucial. High-quality photos and compelling descriptions can make your property stand out.

A well-maintained and thoughtfully designed cabin can generate significant passive income.

Think about amenities that will attract renters, such as a hot tub, a fire pit, or high-speed internet. These small investments can lead to higher nightly rates and more bookings. According to a report by AirDNA (2025, Austin, TX), unique stays like cabins and tiny homes consistently outperform traditional rentals in terms of revenue growth. This data supports the idea that your small cabin can be a powerful financial asset, making the pursuit of cabin financing US a worthwhile endeavor.

Financial Planning Tips

Proper financial planning is the foundation of a successful cabin purchase. Before you even start looking at properties or lenders, you need to get your financial house in order. This involves creating a detailed budget, saving aggressively, and understanding all the costs involved. A solid plan will guide you through the tiny pine cabin financing process with confidence.

Mistakes to Avoid

Many aspiring cabin owners make preventable financial errors. Being aware of these common pitfalls can save you time, money, and stress.

One major mistake is underestimating the total cost of ownership. The sticker price of the cabin is just the beginning. You also need to budget for land, utilities, insurance, property taxes, and ongoing maintenance. Another common error is not shopping around for the best loan terms. Settling for the first offer you receive could cost you thousands of dollars in interest over the life of the loan.

Warren Buffett offers wisdom that applies perfectly here: “The most important thing to do when you find yourself in a hole is to stop digging.”

If you find your budget is too tight or your debt is too high, pause your cabin search. Take the time to improve your financial situation before taking on a new loan. A rushed decision is rarely a good one, especially when it comes to a significant purchase like a home. This disciplined approach is key to achieving affordable pine homes finance.

FAQ

How can I finance a tiny cabin with bad credit?

Financing with bad credit is challenging but not impossible. Focus on lenders who specialize in subprime loans, but be prepared for higher interest rates. You can also explore owner financing, where the seller of the cabin or land acts as the bank. Saving for a larger down payment (30% or more) can also significantly increase your chances of approval by reducing the lender’s risk.

Why is it harder to finance a tiny home than a traditional house?

It is more difficult because tiny homes often do not fit neatly into established real estate categories. If the home is on wheels, it’s considered personal property like an RV, not real estate. This limits mortgage options. If it’s on a foundation, it may not meet the minimum square footage requirements for a conventional mortgage. Lenders see these as non-standard assets, which represents a higher risk.

What’s better: a loan from a bank or a credit union?

For tiny home loans, a credit union is often the better choice. Credit unions are non-profit organizations and are typically more member-focused. They may offer more flexible lending criteria and lower interest rates than large, traditional banks. They are also more likely to understand the local market and be willing to work with you on a non-traditional property.

Before moving to the final planning tips, check out this practical YouTube video that delves into the ins and outs of [key: tiny pine cabin financing]. It covers the main loan types, lender expectations, and actionable strategies for securing funds for your tiny pine cabin in the U.S. This clear, real-world guide will be invaluable as you begin your financing journey.

Conclusion

The journey to owning a small woodland home is filled with unique financial considerations. The key is thorough preparation and research. By understanding the different financing options, strengthening your credit, and saving for a solid down payment, you can navigate the process successfully. Explore personal loans, RV loans, and government-backed programs to find the best fit. Remember to compare lenders and negotiate for the most favorable terms. With a smart financial strategy, your dream of a peaceful retreat is well within reach. Take the first step today by evaluating your finances and exploring your options for tiny pine cabin financing.

Before you begin your financing journey, get organized with our complimentary checklist. This printable A4 guide is designed to walk you through every critical financial step, from assessing your credit to comparing lender offers. Use it to track your progress and ensure you don’t miss a single detail on your path to owning a tiny pine cabin. Download your free checklist below.

Leave a Reply